child tax credit 2021 dates november

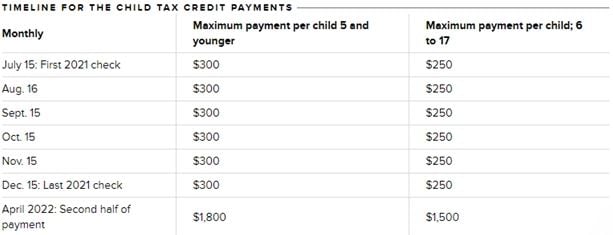

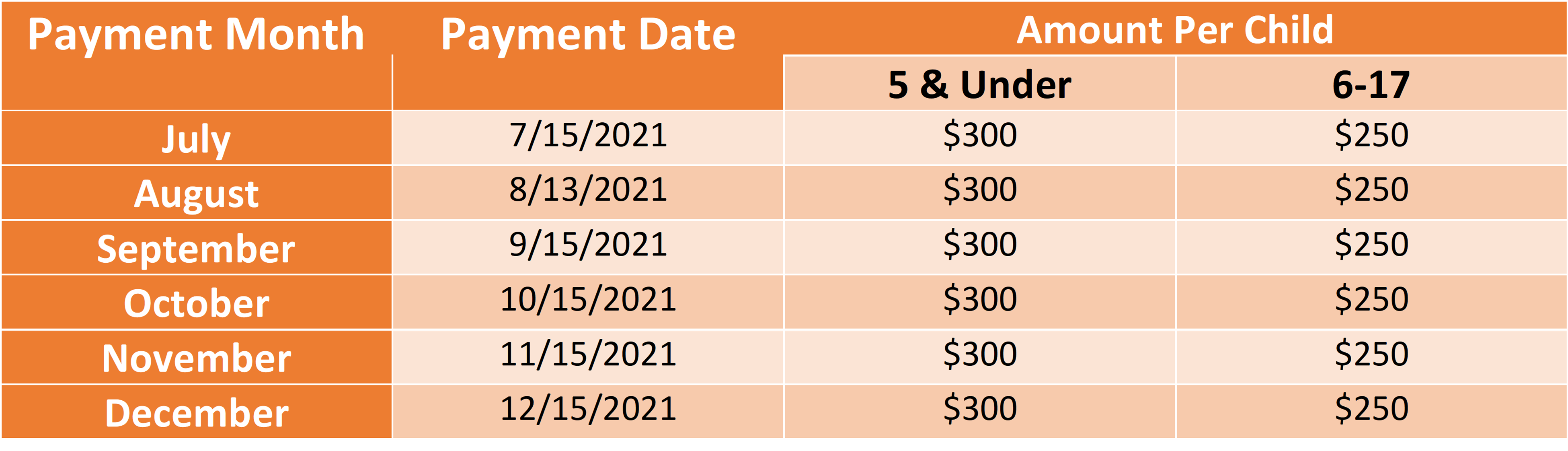

Web For these families each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17. Like the prior payments the.

Stimulus Update When Will The Child Tax Credit Payment For November 2021 Get To You Gobankingrates

15 2022 according to the.

. Web The child tax credit payments of 250 or 300 went out to eligible families monthly from July to December 2021. Web September 20 2022. Web Four payments have been sent so far.

Web Even if you have no earned income and have not yet filed a 2021 tax return you can still get a credit of up to 3600 if you claim it by Nov. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible. Web The full child tax credit benefit is eligible for incomes up to 75000 for individuals 112500 for heads of household and 150000 for married couples.

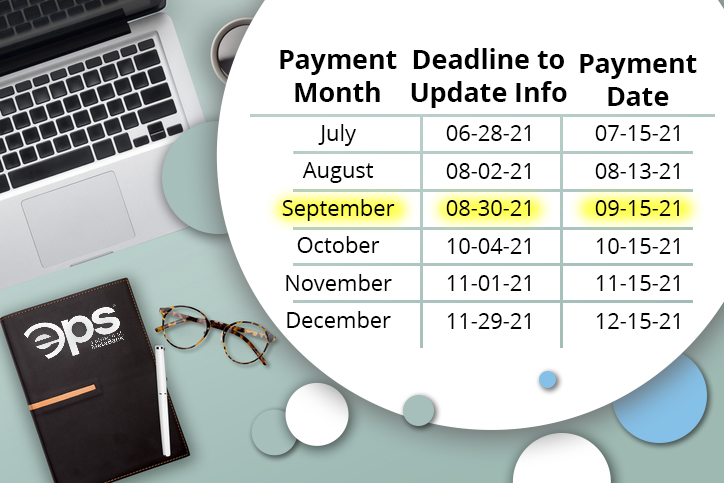

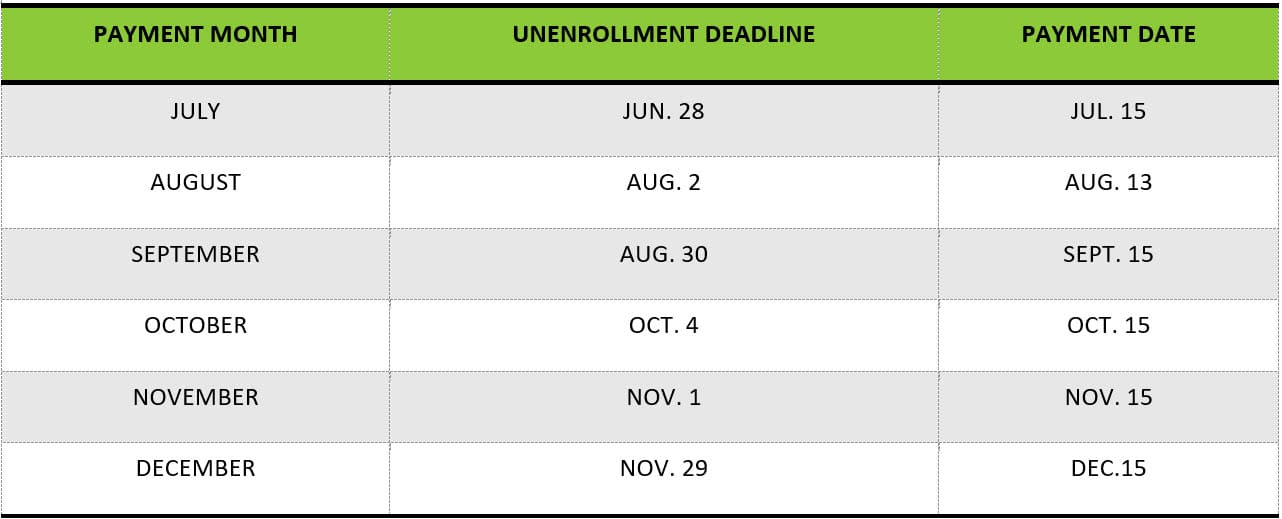

Web Under the Biden administrations 2021 American Rescue Plan the child tax credit was expanded from 2000 per child to 3000 per child for children over the age. Web The advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November. July August September and October with the next due in just under a week on November 15.

13 opt out by Aug. You will not receive a monthly payment if your total benefit amount for the year is less than 240. Web For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids.

Families will see the direct deposit payments in their accounts starting November 15. 28 December - England and Scotland. Web Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased.

Web THE DEADLINE to opt-out of the child tax credit for November is approaching and those who dont want to receive the next child tax credit have until. Depending on the age of the children some. Alberta child and family benefit ACFB All payment dates.

The enhanced child tax credit which was created. Web The remaining payments will arrive October 15 November 15 and December 15 each total up to 300 per child under age six and up to 250 per child ages six. 15 opt out by Nov.

The last opt-out deadline for the last future payment of the current version of the advance Child Tax Credit is. Web MAXIMUM CREDIT. Web Wait 10 working days from the payment date to contact us.

Web You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. Web For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids. Web Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year.

Web The deadline for the next payment was November 1. The largest single child tax credit payment will be up to 1800 per child next year but until then people will get six smaller payments in total. Web Visit ChildTaxCreditgov for details.

Its simply a case of. The opt-out date is on November.

Stimulus Update The Child Tax Credit Opt Out Deadline Is November 4 Gobankingrates

Maria Cervantes Mc S Tax Financial Group You Are Not Required To Receive Monthly Child Tax Credit Payments This Year Instead You Can Choose To Get A Payment In 2022 And The New

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Eps Powered By Pathward The Child Tax Credit Payments Pros And Cons To Think About

Tax Tip 2021 Advance Child Tax Credit Information For U S Territory Residents Tas

November 15 2021 Deadline For Non Tax Filing Families To Use Child Tax Credit Portal Lone Star Legal Aid

Child Tax Credit Payment Schedule For 2021 Kiplinger

Monthly Payments For Families With Kids The 2021 Child Tax Credit United For Brownsville

Using The Child Tax Credit To Boost Your Banking

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat Center On Budget And Policy Priorities

Housing Neighborhood Revitalization Resolutions Of Support For Tax Credit Developments

Irs Makes First Payments Of Advanced Child Tax Credit On July 15 Wfmynews2 Com

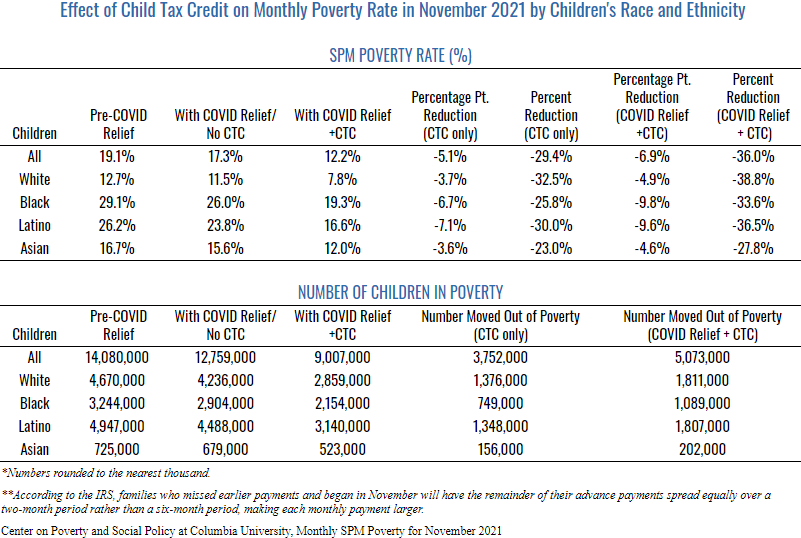

November Child Tax Credit Payment Kept 3 8 Million Children From Poverty Columbia University Center On Poverty And Social Policy

Elm3 S Guide To The 2021 Child Tax Credit Tax Accountant Financial Planner

Individuals Recently Separated Or Divorced Stripped Of Stimulus And Advanced Child Tax Credit Payments Lone Star Legal Aid

Child Tax Credit Advanced Payments Information Bc T

35 Million Families Will Lose Biden Child Tax Credit Payments If Congress Doesn T Act

Final Child Tax Credit Payment Opt Out Deadline Is November 29 Kiplinger